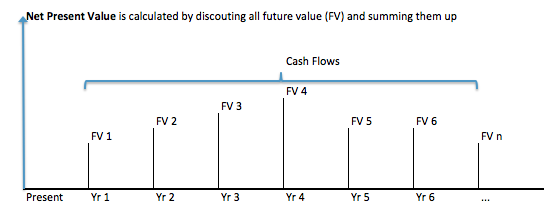

NPV is short for net present value.

A good analogy for NPV is a mortgage.

It has an interest rate and payments over time. The total paid back is larger than the amount borrowed.

If people can get a little more abstract, you can frame it as “time preference”. Would you rather have $1,000 now or $1,100 next year? They are worth different amounts. Ask them to pick a number X to receive next year so that they wouldn’t know if they wanted to choose X next year or $1000 now. The ratio is the discount rate. This gets the basic concept across. Then you say if you have a more complicated pattern of payments, you can apply the same principle over and over again – two years out is discounted twice, etc. So the NPV is the amount of money today where are you indifferent to a complex guaranteed series of payments.

0 Comments