Expected value is one of the most frequent mentioned words in our system. It is used to compare among several projects as it is a single numeric value on a project‘s risk and return. It is also used in a budget decision view, the expected value is what you can expect to get over time when you have a portfolio.

What exactly is expected value?

I did a google search on "expected value", and here is the official definition:

"a predicted value of a variable, calculated as the sum of all possible values each multiplied by the probability of its occurrence".

In another word, it is a value representing all possible outcomes and their corresponding likelihood of occurrence. So what possible outcomes do we consider when we say "expected value"? Didn't the definition already mention "all"? Yes, you are right. We consider all possible outcomes, and we take all kinds of uncertainties of a project into consideration. However, the assumption is that the company has a fairly competent team in execution of the project.

Before we jump into any uncertainty, I would like to introduce you to "base case". This may be a single number or a financial table of numbers over time. Base case is the most likely representation in any company discussion despite it doesn't recognize any uncertainty.

Now let's talk about uncertainties, we classify them into two kinds: development uncertainty and market uncertainty. Expected value represents values when taking both development uncertainty and market uncertainty into consideration. We use timing to separate these two kinds of uncertainties.

What are included in development uncertainty?

Before product launch to the market, the uncertainties we encounter are called development uncertainties. They are related to how difficult it is to deliver the project and to launch it to the market. Things like how hard it is for the team to come up with an effective technology, how easy it is to control the price point, how likely people will change their behavior to use your solutions - can be obtained from market research, etc. The development uncertainties are usually expressed in probabilities of success for different killing issues the team come up with in multiple phases. It helps us understand the risks to get to the market, improve the path and plan to launch, and forecast the success across portfolio.

What are included in market uncertainty?

Once the product is launched to the market, the market uncertainties kick in. They are related to how big is the market size, how many people would be interested, what will the prices and costs be, etc. We recommend using ranges to represent different market uncertainties. With market uncertainties, we will be able to question on the base case -- how reasonable is it? Is there a way we could drive upside potential revenue and mitigate downside risk?

How to identify and communicate the values?

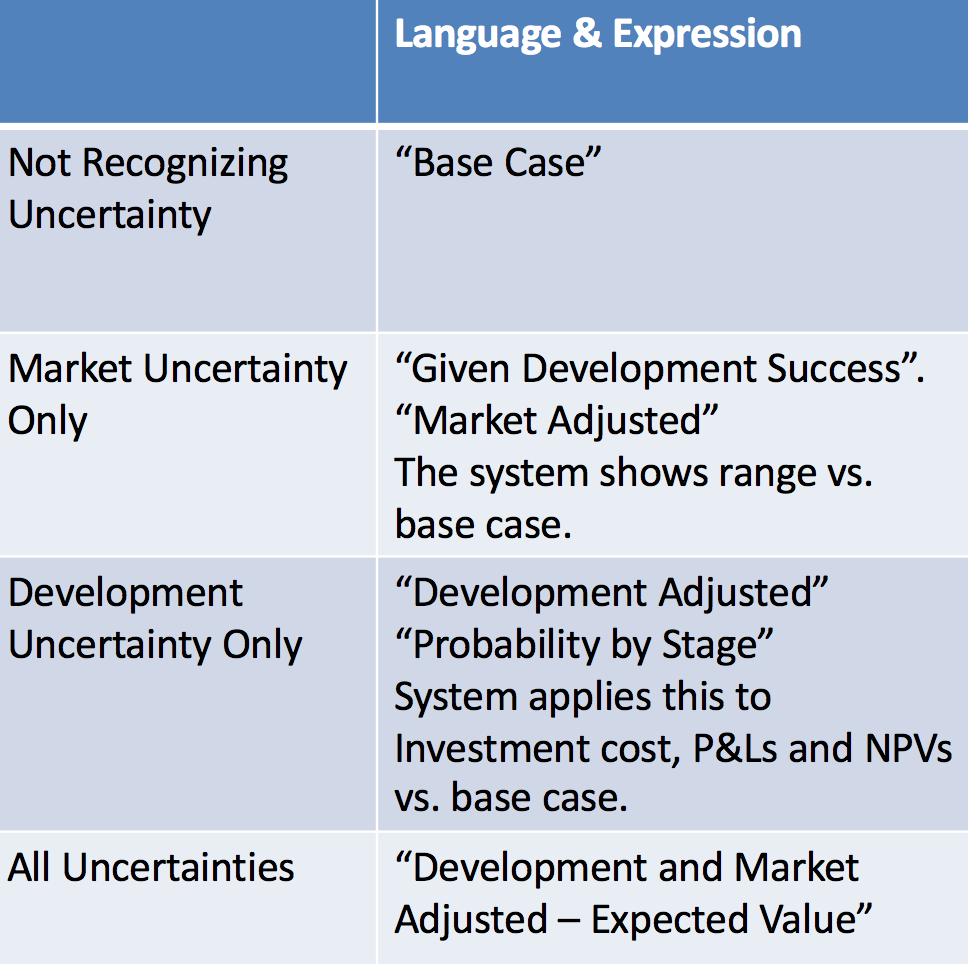

Now you are clear on the definition of development uncertainty and market uncertainty. But the values you see on the summary tree page still confuse you. What does commercial contribution given success mean? How about expected project cost? Believe it or not, you are not alone. Everyone has been through. In a training meeting we worked with clients and finally come up with some easier to understand names. We summarize them in the following table:

We recommend to use the expressions in the table above to communicate with your colleagues. If you have other better suggestions, we would invite you to leave a comment and share with others.

0 Comments